Thought of the Week:

My wife and I downsized a couple years ago. Like many parents, we became empty nesters once our kids went away to college. After four years of school for one, and five for another, my son headed to New York with a girlfriend, and my daughter decided she wanted to live much closer to work than our suburban Maryland home could afford her. Truth was, when the kids weren’t home, we didn’t use much more of the house than our bedroom, kitchen, and family room anyway; plus, down two helpers, the full complement of snow shoveling and yard work was going to fall on one person. So, we took a chance, downsized into a condo, and realigned our lifestyle. About the same time that my wife and I were adjusting to new routines, discussions in Washington and lobbying circles were being had about whether companies were realigning toward the Democratic Party. Washington had just gone through four years of the Trump administration, January 6 had taken place, and there certainly seemed to be a greater corporate emphasis on cultural/societal issues. Now, comes some political research by the Public Affairs Council (PAC) that not only answers this question but also provides insight into the ways companies interact with the political system around them. What the PAC found was that there was simply no evidence that interest groups “buy” public policy wins through lobbying and campaign contributions. Instead, PAC scholars found what government affairs professionals and lobbyists already knew—interest groups use various tools, including political contributions, to build relationships with policymakers in hopes that those relationships will help them influence policy decision-making. Specifically, companies and other interest groups focus their contributions on lawmakers who have the ability to influence their policy priorities, and as a result, Congressional leaders, committee chairs, and influential policymakers receive more contributions from corporate PACs than rank-and-file members. Several trends also emerged from the research. First, a critical mass of companies gives equally to both political parties. Looking at company Democrat to Republican giving ratios in each election cycle, it was found that although some companies favor Republicans or Democrats, most balance their giving between the parties. There are significantly more companies that give relatively equal amounts to Democrats and Republicans compared with those who strongly favor one party over the other. And while the typical company maintains a politically neutral stance across election cycles, there are differences in political posture based on company type. Second, among companies that do favor one party over the other, more favor Republicans. There are significantly more Republican-leaning companies compared with Democratic-leaning companies, and this pattern held consistent, even in election cycles when Democrats held the majority in Congress. Third, these patterns continued after Jan. 6. Although the media and political consultants predicted that companies would begin to favor the Democratic Party considering changing corporate positions on social issues, shifting party dynamics, and events like Jan. 6, the study found no clear evidence of such a shift. Companies were far more likely to be politically neutral in the election cycle immediately after January 6 than they were to favor Democrats. Even after holding constant company preferences, the political environment in the company’s home state, and the size of the company, firms were no more likely to favor the Democratic party following January 6 than they were before it. In fact, in all of the other election cycles, companies were more likely to favor Republicans than Democrats. According to the data companies use giving and lobbying as tools for establishing and maintaining relationships with key policymakers. Companies are more likely to maintain political neutrality than they are to strongly favor one party or the other, but when they do favor a party, they tend to favor Republicans. This lack of realignment is not so much different than my own—we still basically only use the bedroom, kitchen, and family room.

Thought Leadership from our Consultants, Think Tanks, and Trade Associations

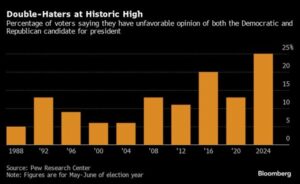

Bloomberg Government Reports that One in Four Voters are Double-Haters—Rejecting Trump and Biden. The ranks of double-haters—voters who say they don’t like either major party presidential candidate—are at a historic high and make up one-quarter of the electorate; that is nearly twice as many as at this point in 2020. While double-haters were a key factor in former President Trump’s win in 2016, when they broke for the Republican candidate over Democrat Hillary Clinton, President Biden won many of those voters over on his way to winning the White House in 2020. Biden and Trump are taking roughly equal measures of these disillusioned voters in battleground states, with Biden winning 25% to Trump’s 22%, but the biggest threat to Biden and Trump is that voters turned off by them will simply stay home—or find refuge in an independent candidate like RFK Jr., who is polling at 24% among those same voters. Growing political polarization is driving the unpopularity; research has found that presidential candidates are only slightly less popular within their own party than they were three decades ago, but that voters of the opposing party are much more negative.

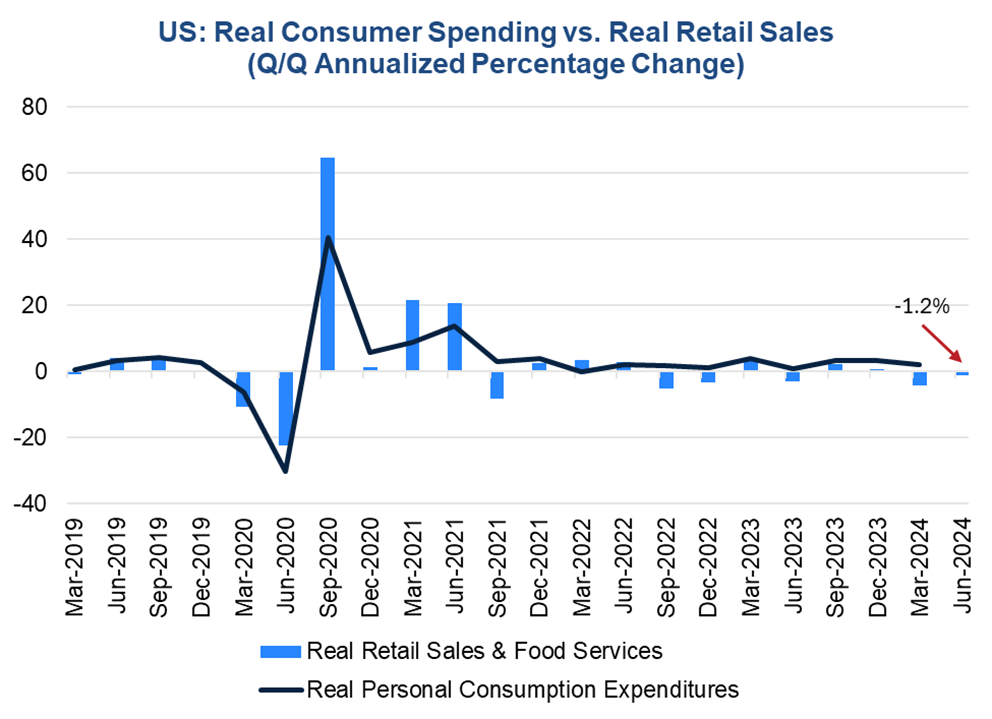

The Conference Board’s Latest Economic Forecast for the U.S. Economy. The U.S. economy started 2024 on a soft note as elevated inflation and interest rates weighed on the economy. While a recession is not forecast in 2024, consumer spending growth is cooling and overall GDP growth will slow to under 1% over the Q2 to Q3 periods. Thereafter, inflation should gradually normalize to the Fed’s 2% target as quarterly GDP growth rises toward its near 2% potential. Interest rates should begin to fall in late 2024 but may stabilize at levels exceeding their pre-pandemic averages. Although consumer spending held up well in 2023, this trend has begun to wane. In fact, real consumer spending growth is in retreat and consumer expectations suggest a downturn. Gains in real disposable income are softening, pandemic savings have been exhausted, and household debt is increasing. Consumers are spending more of their income to service debt, and auto loan and credit card delinquencies are rising. Taken together, these factors suggest that consumer spending growth will slow in Q2 and Q3 as households struggle to find equilibrium between income, debt, savings, and spending. While labor markets will soften over this period, they will not deteriorate. Business investment slowed in Q1 as high interest rates weighed on financing activities; this trend will intensify as the Fed awaits additional progress on inflation. Residential investment, a bright spot in the economy, has been performing better; however, as consumers grapple with their finances and builders face high interest rates this trend will slow. Government spending was a positive contributor to economic growth in 2023 due to non-defense spending associated with the infrastructure legislation passed in 2021 and 2022. This tailwind has not abated and these spending programs will continue to support GDP growth. However, political volatility surrounding fiscal policy, debt, and outlays could impact government spending over the next few years. Labor market tightness remains, and the trend is underpinned by the retirement of Baby Boomers and the reluctance of businesses to lay off workers. On inflation, progress was made in 2023 but improvements stalled in Q1. April and May inflation data revealed a resumption in the slowing trend, but additional progress will be needed to achieve the Fed’s 2% inflation target. The forecast is for inflation to slow to 2% by Q2 2025. The Fed will implement two 25 basis point rate cuts toward the end of this year.

Although Alarming, Eurasia Group Says CBO Projections are Unlikely to Spur Action on Deficits. The Congressional Budget Office (CBO) released updated economic projections, and according to the new figures, the national debt is poised to top $56 trillion by 2034, with annual deficits equivalent to 6.9% of GDP—significantly more than the 3.7% that deficits have averaged over the past 50 years. This grim fiscal reality will be the backdrop for a tax and spending battle in 2025, when Congress is likely to extend most, if not all, of the 2017 Trump tax cuts under any alignment of power after the election. Further moves—such as tax breaks for flow-through businesses, an expanded Child Tax Credit, higher taxes on the wealthy, and/or ending the income tax on tipped wages—are likely to be on the table as part of the discussions, but tightening fiscal space will limit what Congress can do. Nonetheless, there is little appetite in Congress for dealing with outstanding fiscal questions immediately. In fact, according to Fitch, despite the rising debt levels, no matter who wins in November, the “offsetting strengths” of the U.S. economy provide “more tolerance to absorb a rising debt-to-GDP ratio than other ‘AA’ category sovereigns.” While the tax debate will create pressure to look for new revenue or spending cuts, even if these materialize the country’s long-run debt trajectory will change little after the election.

“Inside Baseball”

The Presidential Debate in Atlanta is a Week Away. Details of the debate have emerged, including: (1) There will be two commercial breaks. Unlike previous presidential debates, corporate sponsors will interrupt the 90-minute event. While this will allow both candidates to take a breather, campaign staff is not supposed to interact with their candidate during that time. (2) No opening statements. Each side gets two minutes for answers and one minute for rebuttals. There will be two-minute closing statements. (3) Mics will be muted when it’s not the candidate’s turn. The mic rule could create a stifled event as many of the best moments from past debates have been asides or interjections made when it wasn’t the candidate’s turn to speak. (4) Robert F. Kennedy, Jr. will not be on stage. Ballot access is the problem. Currently, RFK, Jr. is not on the ballot in enough states to theoretically win 270 electoral votes. Punchbowl News reports that President Biden will go into debate camp; his team has blocked off the final week before the debate for preparation including rehearsals with a stand-in opponent. Former President Trump will wing it.

In Other Words

“Debates are interesting because I had never debated before and then I debated a lot in 2016. It’s been good for me…I think I won every debate,” former President Trump on his preparations for the June 27 debate against President Biden.

Did You Know

The original salary for a U.S. Senator or member of Congress was $6 per diem in 1789; it was raised to $1500 per annum in 1815; and it currently stands at $174,000 per annum.

Graph of the Week

Retail Sales Confirm Consumer Spending Pullback. According to the Conference Board, nominal retail sales edged up 0.1% in May following a 0.2% decline in April. Real retail sales also rose by 0.1% in May after a dramatic 0.5% decline in April. Nonetheless, real retail sales over the April-May span were down 1.2% from Q1, suggesting consumer spending continued to be weak in Q2. The May retail sales data support expectations that real GDP growth continued to slow in Q2 after rising just 1.3% in Q1. The Fed will likely view the data as constructive in terms of cooling the economy toward its 2% inflation target. Financial markets have rallied as the data supports the narrative for the central bank to cut rates later this year. The anticipation is for two rate cuts towards the end of 2024, likely at the November and December meetings.