Thought of the Week:

I’ve got good news and I’ve got bad news…The good news is that much of official Washington remains away from the city on recess…the bad news is that they’ll be back right after Election Day for a hectic lame duck session that will run right up to the holidays. Earlier this week, the good news was that I took advantage of Maryland’s early voting period…the bad news is that I’ll have to wait nearly a month to find out who wins. And at the end of the week, the good news is that both my NFL teams, the Ravens and the Commanders are playing, the bad news is they’re playing each other. Good news/bad news is also in the air for D.C.’s consultants, lobbyists, and corporate offices who are all scenario planning for either a Harris or Trump administration. In fact, if you were at my presentation to SCOA’s credit managers in Nashville last month, you would have heard me expand on the good news/bad news atmosphere facing companies…and you would have heard me warn that the good news/bad news would come regardless of who’s eventually elected president. Let’s start with some good news we’ve seen in the near-term—last month the Federal Reserve cut interest rates, there’s been a gradual decrease in the pace of inflation toward the Fed’s 2% target, we just saw a better-than-expected jobs report, and post-pandemic private investment has continued to grow despite elevated interest rates. The bad news comes in the medium-term, and it includes a combination of unsustainable public finances, a looming commercial property disaster, and a drift towards protectionist trade policy. According to the Congressional Budget Office (CBO), whoever wins November’s presidential election will inherit a budget deficit of 7% of GDP and a public debt of nearly 100% of GDP; at a time of full employment, the budget should be in balance. The CBO warns that present day policies will lead public debt to exceed 120% of GDP by 2034 and 166% of GDP by 2054. These numbers would be higher than at the end of World War 2, and with less favorable demographics than at the time of the baby boom, there is little prospect of the U.S. growing its way out of its debt problem. Against this background come lavish campaign promises, by both presidential candidates. While Vice President Harris proposes new initiatives ranging from increased childcare spending to support for the housing industry, former President Trump is proposing unfunded tax cuts from the extension of his 2017 tax cut to an additional reduction in the corporate tax rate. The lack of political will to address the budget deficit not only risks a dollar crisis, but also slower economic growth, losses in purchasing power, hits to the fiscal and economic outlooks, and is likely to place restraints on lawmakers’ future policy choices. A second item of bad news is the looming commercial property crisis. Office prices in U.S. cities have dropped more than 50% due to record high vacancies caused by the work-from-home trend. This throws into question the ability of property owners to roll over $1.5 trillion in loans that will mature by the end of next year at higher interest rates than those at which they were originally financed. A wave of defaults in 2025 is not out of the question, and the National Bureau of Economic Research (NBER) suggests that as many as 400 small and medium-sized banks are likely to fail over the next few years. A third concern is that the U.S. is becoming increasingly protectionist in its trade policies. Both candidates favor “America-first” policies, and the former president has announced, if elected, he would impose a 60% tariff on all Chinese imports, a 10%-20% tariff on all imports from the rest of the world, and a 200% tariff on American companies that outsource manufacturing production abroad. Such tariffs would increase inflation by a full percentage point and constitute an effective tax of $2,500-$4,000/year on the average American household. Even worse, such tariffs are bound to invite retaliation by trade partners. We’ve got good news: two more 25 basis point cuts to come before year-end; and we’ve got bad news: a less favorable economic environment next year, and the prospect of markets being less forgiving of budget imbalances than they have been to date.

Thought Leadership from our Consultants, Think Tanks, and Trade Associations

Brookings Says Tariffs on All Imports would Cause Chaos for Business. Former President Trump, if reelected, seems intent to levy tariffs on all U.S. imports, even though experience shows, and economists agree, that tariffs lead to persistently higher prices for customers. Moreover, the near-term damage of tariffs could be great if supply chain disruptions create chaos for businesses that rely on imports. Trump has promised to increase tariffs on imports from China by 60% and on all other imports by 10%-20%. His insistence that this would not lead to higher prices reflects a basic misunderstanding of how tariffs work in practice. When an importer brings a good into the U.S., it pays a tariff to the federal government equal to a percentage of the price paid to the foreign exporter. Importers have three choices: (1) pass the tariff on to the customer; (2) eat the tariff and suffer lower profits; or (3) renegotiate supply contracts/switch to lower price suppliers (a costly process). While some exporters will lower prices to stay competitive in U.S. markets, studies show that past price reductions by exporters were minimal at best. During the previous Trump administration, the 2018–19 tariffs nearly always led to higher prices for affected goods—in fact, prices were higher by the full tariff amount. The 2018–19 tariffs also had other negative effects, including: (1) reduced exports by U.S. manufacturers that relied on imported intermediate goods; and (2) retaliatory tariffs by other countries. A less visible cost came from appeals for exemptions, where politically favored importers won tariff relief from the Trump White House. In considering how costly proposed tariffs on all imports would be, note that these tariffs would be on more than 10 times the number of imports as the first Trump trade war; the repercussions of these tariffs would be felt by every firm that sells imported goods and by every firm that uses imported inputs—prices would rise, production would decline, and employment would fall, particularly in sectors exposed to higher input prices or foreign retaliation. The prospect for near-term chaos would rise as importers and purchasers of imported goods would scramble to renegotiate contracts, reconfigure supply chains, and lobby for tariff exemptions—all in a highly politicized environment.

Committee for a Responsible Federal Budget Outlines the Fiscal Impact of the Harris and Trump Campaign Plans. The next President will face significant fiscal challenges upon taking office, including record debt levels, large structural deficits, surging interest payments, and the looming insolvency of critical trust fund programs. While the U.S.’s large and growing national debt threatens to slow economic growth, boost interest rates and payments, weaken national security, constrain policy choices, and increase the risk of an eventual fiscal crisis, neither major candidate running in the 2024 presidential election has put forward a plan to address the rising debt burden. In fact, a comprehensive analysis of the candidates’ tax and spending plans finds that both Vice President Harris and former President Trump would further increase deficits and debt above levels projected under current law. Under one central estimate, Vice President Harris’s plan would increase the debt by $3.50 trillion through 2035, while President Trump’s plan would increase the debt by $7.50 trillion. These estimates come with a wide range of uncertainty, reflecting both different interpretations and estimates of the policies. Under low- and high-cost estimates, it is estimated that Vice President Harris’s plan could have no significant fiscal impact or increase debt by $8.10 trillion through 2035, while President Trump’s plan could increase debt by between $1.45 and $15.15 trillion.

Eurasia Group Says Don’t Expect to Know the Winner on Election Night. Recounts, challenges to state and local vote certification, and litigation are likely following the U.S. election. Former President Trump appears likely to use all available options to challenge a Harris victory, although recounts are expected regardless of who wins. While legal mechanisms will probably resolve any challenges before the December 17 deadline to submit electoral results to Congress, slow ballot counting in states like Georgia and Pennsylvania imply that the true election outcome may not be known for several days; and even if the winner quickly becomes obvious, results may not be formalized for several weeks. The risks of disruptions to election administration are relatively low in the Rust Belt swing states of Michigan, Pennsylvania, and Wisconsin due to changes in state laws after 2020. However, risks are higher in the Sun Belt states of Arizona, Georgia, and Nevada. In Georgia, two recent rules by the State Election Board—one requiring officials to make “reasonable inquiry” into results before certifying, and the other mandating a hand count of all ballots cast—could create serious confusion and delay certification. In Pennsylvania, idiosyncratic recount rules could invite a flurry of petitions that bog down state courts and delay certification, as occurred during the 2022 midterms. Key players to watch are governors, who are the chief election officials in the swing states, state and federal courts, and Republican officials in the House and Senate, who will be under pressure from the former president to cast further doubt on the process of verifying a close election.

“Inside Baseball”

October 7 Changed Washington. This week marked one year since Hamas’ October 7 terror attack on Israel. The rampage left more than 1,200 Israelis dead and hundreds held hostage. More than 40 Americans were killed, and four remain as hostages. The ensuing Israeli military campaigns to destroy Hamas in Gaza and Hezbollah in Lebanon have led to tens of thousands of Palestinian deaths and hundreds of thousands of refugees. Particularly worrying, Israel and Iran, which launched two direct attacks on the Jewish state, may be on the verge of a broader war that could pull in the U.S. The aftershocks of Oct. 7 have seeped deep into American society and changed the nature of U.S. support for Israel. Republicans are as closely aligned with Israel and Prime Minister Netanyahu as ever; the FBI and Department of Homeland Security warn of terrorist attacks; the war has set off a wave of antisemitism at U.S. colleges and led to the resignations of Ivy League presidents; there have been fights within the House Democratic Caucus and Senate Foreign Relations Committee; and the highest-ranking Jewish pol in American history, Senate Majority Leader Schumer (D-NY), openly feuds with Netanyahu. The Democratic Party’s existing divisions over Israel have only got worse. Large contingents of Hill Democrats have sought to use Congress’ power to block or place conditions on U.S. weapons sales to Israel, which would’ve been unheard of pre-October 7. The U.S. has found itself on both sides of the conflict—spending tens of billions to boost Israel while simultaneously supplying billions in humanitarian aid to Palestinians. The White House openly disdains Netanyahu, and when Speaker Johnson (R-LA) tried to pass a $14 billion Israel aid bill along party lines, the Senate and White House rejected the move, and Israel had to wait months to get aid. The assault on Rafah in southern Gaza this spring may have been the low point for U.S.-Israel relations, and the point when Hill Democrats and the Biden administration were openly courting a Netanyahu successor. At the time, Biden withheld American-made weapons, fearful that an assault on Rafah would lead to a massive wave of civilian casualties. Netanyahu and Republicans pointed to the move as a signal that Biden was about to abandon Israel, which led to a furious pushback from the White House. Since then, Netanyahu has ignored Biden’s efforts to force a ceasefire. With war spreading to southern Lebanon and Iran launching missile barrages, the wild card is how Israel responds to the Iranian provocation, and how Iran counters in turn. Netanyahu and Israel have an enormous amount at stake on Election Day. If Harris wins, U.S. support will continue, but with conditions Netanyahu won’t like. If former President Trump wins, Netanyahu will be allowed to do much of what he wants as Trump will merely want credit for an Israeli victory and want it over quickly.

In Other Words

“I think all of us know the Electoral College needs to go. We need a national popular vote…But that’s not the world we live in,” Vice presidential candidate Walz, at a fundraiser with California Governor Newsom.

“What I want to do is work on the transition, and it’s not about placing people. It’s about blocking the people who would be a disaster in the administration. I will cut out so many people, people’s heads are going to spin,” Donald Trump, Jr., speaking about staffing for an aggressive second term agenda.

Did You Know

In 2012 President Obama became the first president in modern political history to win his second term with fewer votes than in his first run for president.

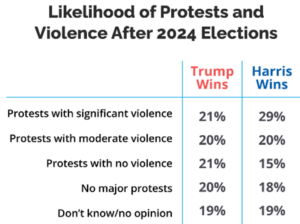

Graph of the Week

A new Public Affairs Council/Morning Consult poll found that Americans are concerned that violent protests could erupt post-election. Nearly half (49%) expect violent protests if Trump loses, but 41% are also worried about violence if Trump wins. Whether violence erupts or not, most Americans expect post-election protests—62% if Trump wins and 64% if Harris wins. In addition, more than two-thirds of Americans (68%) believe disinformation will affect the outcome of the election.